Supporting NEMT Quality with Sustainable Provider Rates

Transportation providers have always served as the backbone of non-emergency medical transportation (NEMT) services, operating as frontline representatives of the NEMT program to the Medicaid members they transport. In the wake of the COVID-19 pandemic, NEMT brokers like MTM and transportation providers have faced unprecedented challenges in the industry. Market factors surrounding inflation have skyrocketed operating costs and have made current Medicaid-limited rates paid to transportation providers unsustainable. The vast majority of transportation providers serving Medicaid NEMT programs are small local business owners that are particularly susceptible to variation in their cost structure. NEMT brokers like MTM supported these providers during the pandemic to help them stay in business, including providing rate relief and gas surcharges. Today, many providers are still facing significant challenges in maintaining their operations at current rates—which is why it is imperative that state Medicaid agencies examine base rates given to NEMT brokers to reimburse transportation providers.

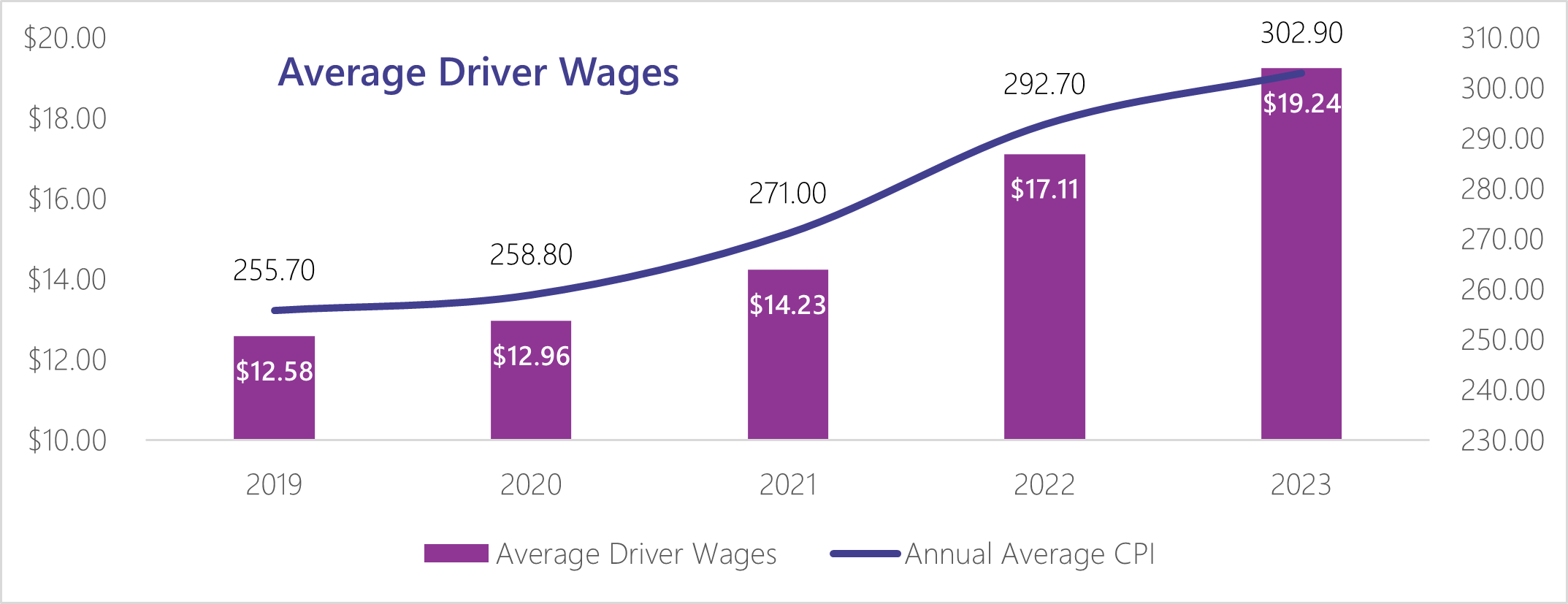

Average Driver Wages Have Increased

In recent years, transportation providers have had to pay qualified drivers more to combat driver scarcity due to competition from other driving services. Inflation has also driven cost of living increases by as much as 8% year over year throughout the past five years, according to the Consumer Price Index (CPI). Based on national data, average driver wages have increased 52.9% from 2019 to 2023.

Source: Federal Reserve Bank of Minneapolis

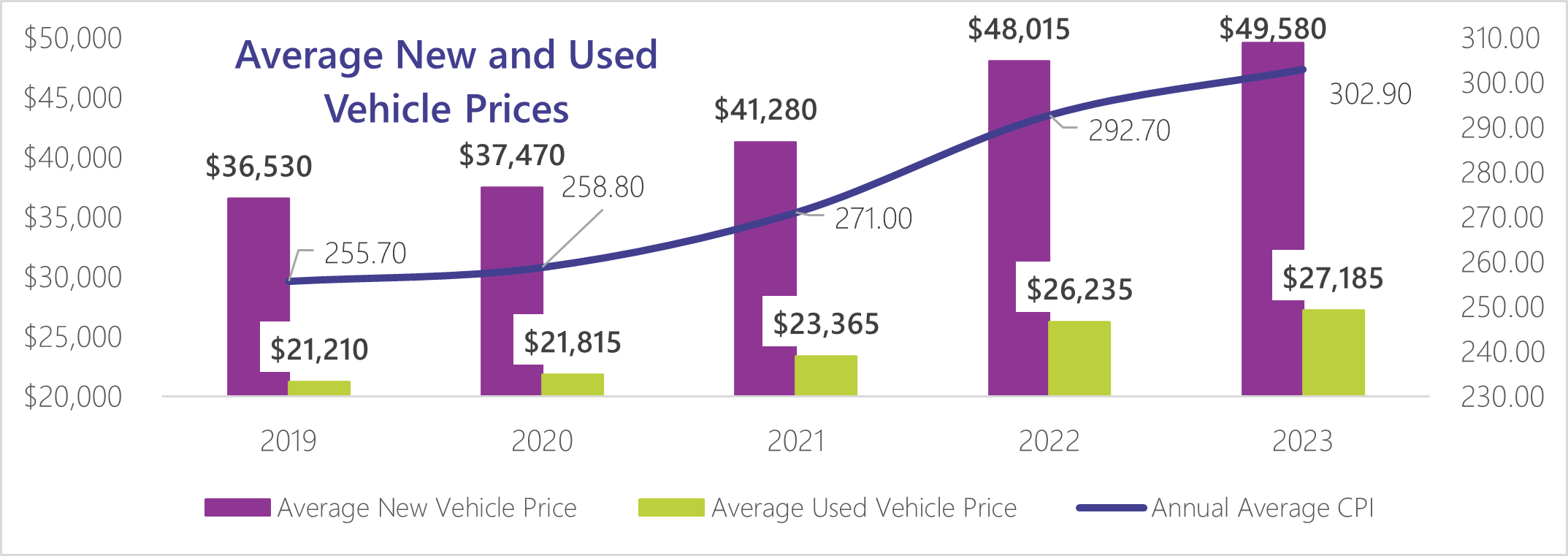

Vehicle Prices Hit Near Record Highs

To continue providing safe, high quality service, transportation providers must ensure they replace retiring vehicles in a timely manner. New and used vehicles are low in inventory and high in demand, with new vehicle buyers routinely paying over sticker value. Average new vehicle prices are up 35.7% since 2019; average used vehicle prices are up 28.1% in the same timeframe. Additionally, interest rates have risen exponentially in a series of rate hikes beginning in March 2022, making vehicle financing more fiscally difficult for providers.

Sources: Kelley Blue Book, Edmunds, the National Automobile Dealers Association, and the Federal Reserve Bank of Minneapolis

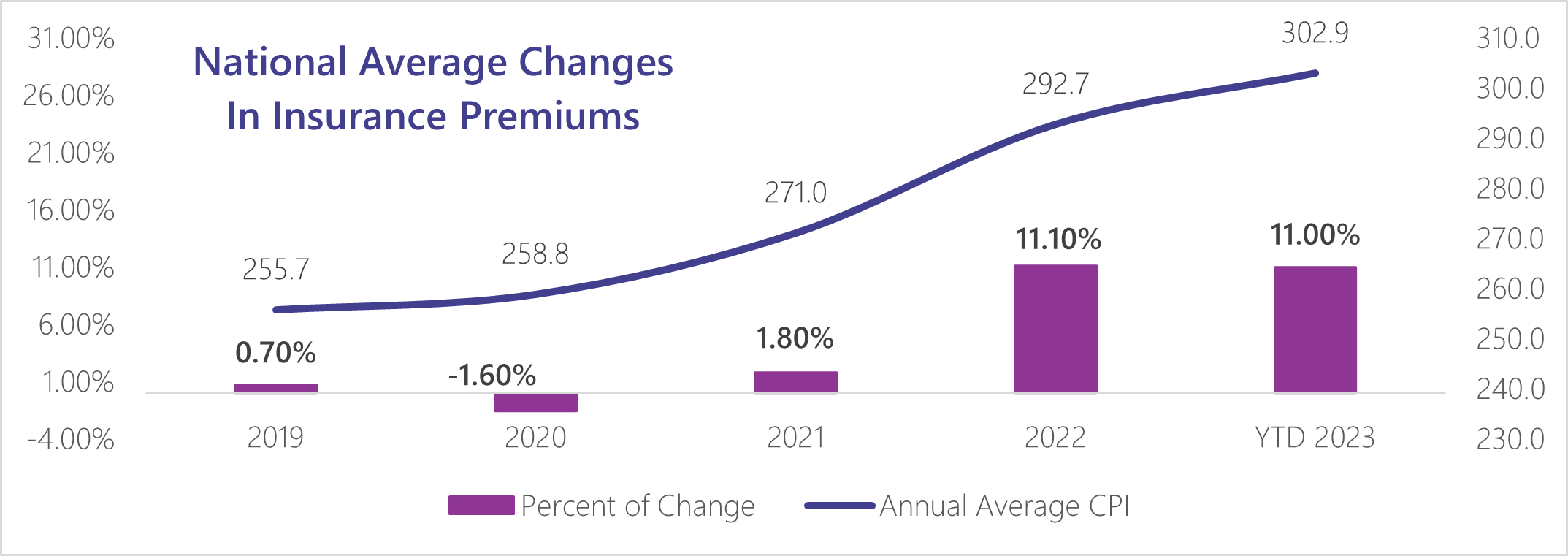

Commercial Auto Insurance Rates Are Rising

Insurance premiums are continuing to increase nationwide, primarily due to efforts to offset historically poor underwriting. Additionally, several carriers have left the NEMT insurance market entirely. As a result of having fewer options, remaining carriers have raised rates for commercial coverage. The following chart shows national average changes in rates from 2018 through present, with the largest cumulative rate increases occurring between 2022 and present.

Sources: carinsurance.com and the Federal Reserve Bank of Minneapolis

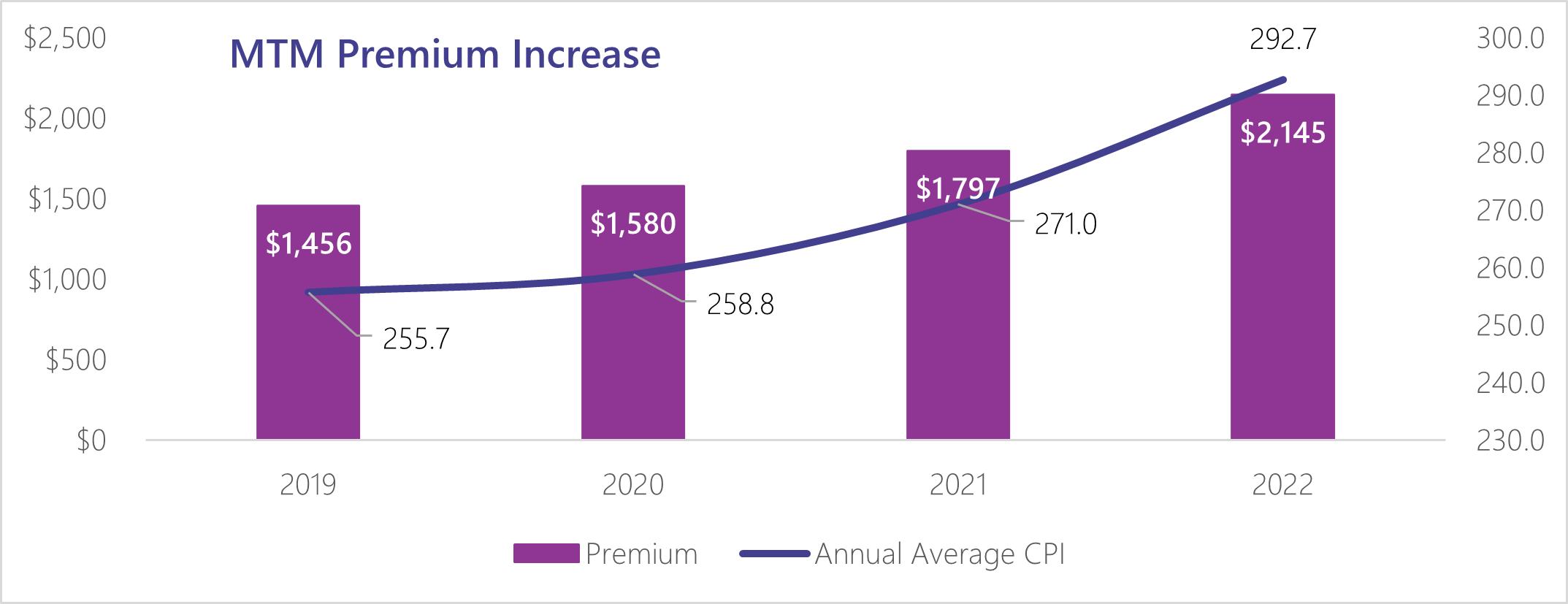

MTM has seen similar increases in our own insurance rates. The chart below shows our historical premiums per vehicle from 2020 to present for a $1 million deductible policy.

Sources: Internal premium data and the Federal Reserve Bank of Minneapolis

Without sustainable rates for transportation providers that allow them to support their operations appropriately, NEMT quality will inevitably suffer. MTM and our leadership team implore state Medicaid agencies to work with their own NEMT brokers to examine similar data and determine where changes can be made to ensure base rates are sustainable well into the future.

Categories

- Alaina Macia (31)

- Employee Wellness (19)

- ETO Newsletter (64)

- Events (70)

- MTM eNewsletter (83)

- News & Events (655)

- Tradeshows (57)

- Uncategorized (17)

- Webinars (15)